FIRE stands for Financial Independence, Retire Early. I first heard of the term several years ago and was very intrigued by it.

I started reading a bunch of finance books and also watched countless Youtube videos to see how I could implement it into my life.

After all, I don’t want to work until I am 65. I want to get to the point where working is something I choose to do, and not something I have to do.

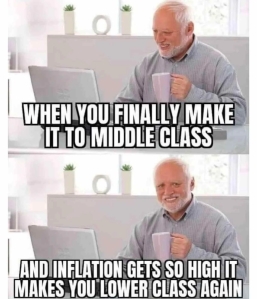

However, with prices going up 3x in the past fifteen years in Toronto, it feels almost like an impossible dream.

The same meal that used to cost $7 now cost $16 (so around $20+ after tax and tips). But wages have not kept up at all. It is getting more and more unaffordable to eat out. Not to mention, the tipping culture here is insane (15-18% on average on top of 13% tax).

Experts suggest that you should take out 4% of your total portfolio and aim to have enough to survive for 30 years. So, if you have $1,000,000, then you would take out $40k, and basically take out money annually and gradually use it all up during your retirement.

However, that’s based on a 30-year retirement AND assuming your investment is beating the inflation. If inflation far exceeds 4%, then you’d need to take out more than 4% in order to have enough purchasing power to maintain your quality of life.

I can’t even imagine how someone would survive if they had retired in the 1970s when prices have gone up 10-15x since then (or probably more).

In all the books I’ve read, they say 1 million is a good number to aim for. But now, you can’t even buy a house for a million.

In fact, retiring with 3 million might not be enough with how things are going.

How long will it even take me to have a million? Let alone three? Sigh.

It just makes me feel like we have to be money slaves forever. So depressing.

So now, I am travelling as much as I can while I am somewhat young. Travelling makes me happy, and at least I feel like I am enjoying my life as I hustle.

For those who can relate, I hope you get to achieve your financial goals while also enjoying your life.

I came across this quote in a book today, and it was a very powerful reminder:

My only regret, in my entire life, is just that I didn’t enjoy it more.

What are your thoughts?

P.S. Blogging about my travelling adventures is too time consuming and exhausting, so I will resume in the future when I have more brain power.

I completely understand your perspective on FIRE (Financial Independence, Retire Early) and the challenges that come with it, especially considering the rising costs of living. It can sometimes feel like an impossible dream, with prices increasing and wages struggling to keep up. The concept of taking out 4% of your portfolio annually for a 30-year retirement assumes that your investments beat inflation, but if inflation exceeds 4%, it becomes even more challenging to maintain your desired quality of life.

It’s true that the goal of having $1 million or even $3 million for retirement might not be enough in today’s world, where housing prices are skyrocketing. The path to reaching such financial milestones can feel overwhelming and distant, leaving us questioning if we’ll ever break free from the cycle of being money slaves.

However, it’s important to find a balance and not let the pursuit of financial independence overshadow the present. Enjoying life and finding happiness in the present moment is equally important. It’s great that you’re prioritizing travel and finding joy in those experiences.

Remember the quote you came across: “My only regret, in my entire life, is just that I didn’t enjoy it more.” This serves as a powerful reminder to find a balance between working towards financial goals and savoring the present. It’s okay to take breaks from blogging or other pursuits when they become overwhelming, allowing yourself the space to recharge and regain focus.

Ultimately, everyone’s financial journey is unique, and it’s important to find what works best for you. Keep seeking knowledge, exploring different strategies, and adapting as needed. With determination, discipline, and a healthy balance, you can work towards financial independence while also enjoying your life. Wishing you all the best on your journey!

Thank you so much for reading and taking the time to make such a meaningful comment!