FIRE stands for Financial Independence, Retire Early. I first heard of the term several years ago and was very intrigued by it.

I started reading a bunch of finance books and also watched countless Youtube videos to see how I could implement it into my life.

After all, I don’t want to work until I am 65. I want to get to the point where working is something I choose to do, and not something I have to do.

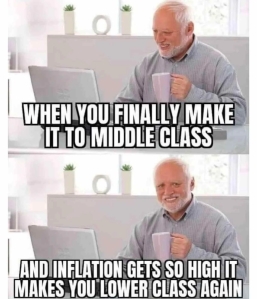

However, with prices going up 3x in the past fifteen years in Toronto, it feels almost like an impossible dream.

The same meal that used to cost $7 now cost $16 (so around $20+ after tax and tips). But wages have not kept up at all. It is getting more and more unaffordable to eat out. Not to mention, the tipping culture here is insane (15-18% on average on top of 13% tax).

Experts suggest that you should take out 4% of your total portfolio and aim to have enough to survive for 30 years. So, if you have $1,000,000, then you would take out $40k, and basically take out money annually and gradually use it all up during your retirement.

However, that’s based on a 30-year retirement AND assuming your investment is beating the inflation. If inflation far exceeds 4%, then you’d need to take out more than 4% in order to have enough purchasing power to maintain your quality of life.

I can’t even imagine how someone would survive if they had retired in the 1970s when prices have gone up 10-15x since then (or probably more).

In all the books I’ve read, they say 1 million is a good number to aim for. But now, you can’t even buy a house for a million.

In fact, retiring with 3 million might not be enough with how things are going. Continue reading “Is FIRE even possible when inflation is so insane?”